work opportunity tax credit questionnaire (wotc)

The Work Opportunity Tax Credit WOTC program is a federal tax credit that employers can use when they hire people from specific target demographics such as disabled individualsIn the. Please take this opportunity to complete an additional applicant assessment.

Completing Your Wotc Questionnaire

The tax credit for target group I long-term family assistance recipient is 40 percent of first year qualified wages up to 10000 and 50 percent of second year qualified wages up to 10000.

. We would like you to know that although this questionnaire is. For example the WOTC can be worth 4800 5600 or 9600 for. WOTC Eligibility Questionnaire The Work Opportunity Tax Credit program WOTC promotes workplace diversity and facilitates access to good jobs for American workers.

Employers can qualify for the WOTC. The tax break can be worth as much as 2400 for each eligible employee hired and even more in other cases. Group for purposes of qualifying for the work opportunity credit.

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. The tax credit for certain employers that operate in an empowerment zone has been extended through December 31 2020. IRS Form 8850.

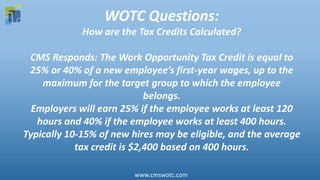

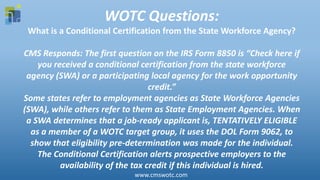

This form provides state workforce agencies with a standardized e-reporting format which accurately reflects program activity levels and outcomes under the WOTC. ETA Form 9062 Conditional Certification. The credit for all eligible employees who work between 120 and 400 hours is 25 of their qualified first-year.

The amount of the WOTC is calculated as percentage of qualified wages paid to an eligible worker during the eligible employees first year of employment. Under this credit an employer may claim a 20-percent credit on. ETA Form 9175 Long-Term Unemployment Recipient Self-Attestation Form.

Businesses in certain designated geographic areas can claim up to 73500 in tax credits per eligible employee over a five-year period to offset income tax liability. The Work Opportunity Tax Credit WOTC is a federal tax credit designed to benefit employers that hire individuals from target groups facing significant barriers to employment. ETA Form 9061 Individual Characteristics Form.

WOTC Work Opportunity Tax Credit is a federal tax credit available to employers rewarding them for every new hire who meets eligibility requirements. Submitting Form 8850 to the SWA is but one step in the process of qualifying for the work opportunity credit. Work Opportunity Tax Credit Questionnaire.

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers for hiring individuals from specific target groups who have consistently faced significant barriers to. A recent law extended the Work Opportunity Tax Credit WOTC for businesses who hire individuals from one or more targeted groups. 5 If the eligible.

The program delivers larger credit amounts for more hours worked.

Dol Issues Revised Forms For Work Opportunity Tax Credit Wotc Wotc Planet

What Is Wotc Screening Irecruit Applicant Tracking Remote Onboarding

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Cost Management Services Wotc Tax Credit Screening

The Work Opportunity Tax Credit S Most Frequently Asked Questions

Wotc Questions Are Employees Required To Fill Out Wotc Form Cost Management Services Work Opportunity Tax Credits Experts

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Leo Work Opportunity Tax Credit

The Work Opportunity Tax Credit S Most Frequently Asked Questions

Work Opportunity Tax Credit Provides Help To Employers Burkett Burkett Burkett Certified Public Accountants P A

What Is The Work Opportunity Tax Credit Wotc Einstein Hr

Wotc 101 Arizona Department Of Economic Security

Myth Buster Work Opportunity Tax Credit Nc Second Chance Alliance

An Employer S Work Opportunity Tax Credit Wotc Guide

Business Owners Help Wanted You May Be Eligible For The Work Opportunity Tax Credit

Completing Your Wotc Questionnaire

Wotc 101 What Employers Need To Know About The Work Opportunity Tax Credit